I’d like to share a little story with you. It serves two purposes. The first being I get to sound off about this issue because well, isn’t that why people blog? OK, just kidding. The real reason I am taking the time to write this is because I have some important information to share that I think some of you may find useful.

After being diagnosed with a blood clot in my leg in 2004, I was tested for several different clotting disorders and found out I had a genetic blood clotting disorder called Factor V Leiden. Then in 2012,, I was also found to have two small blood clots in my lungs. Technically someone like me is supposed to be on blood thinners forever. Why I don’t take blood thinners regularly is a long story for another day. Actually, I think I may have told the story already. I’ve been blogging for a while and I lose track of my topics.

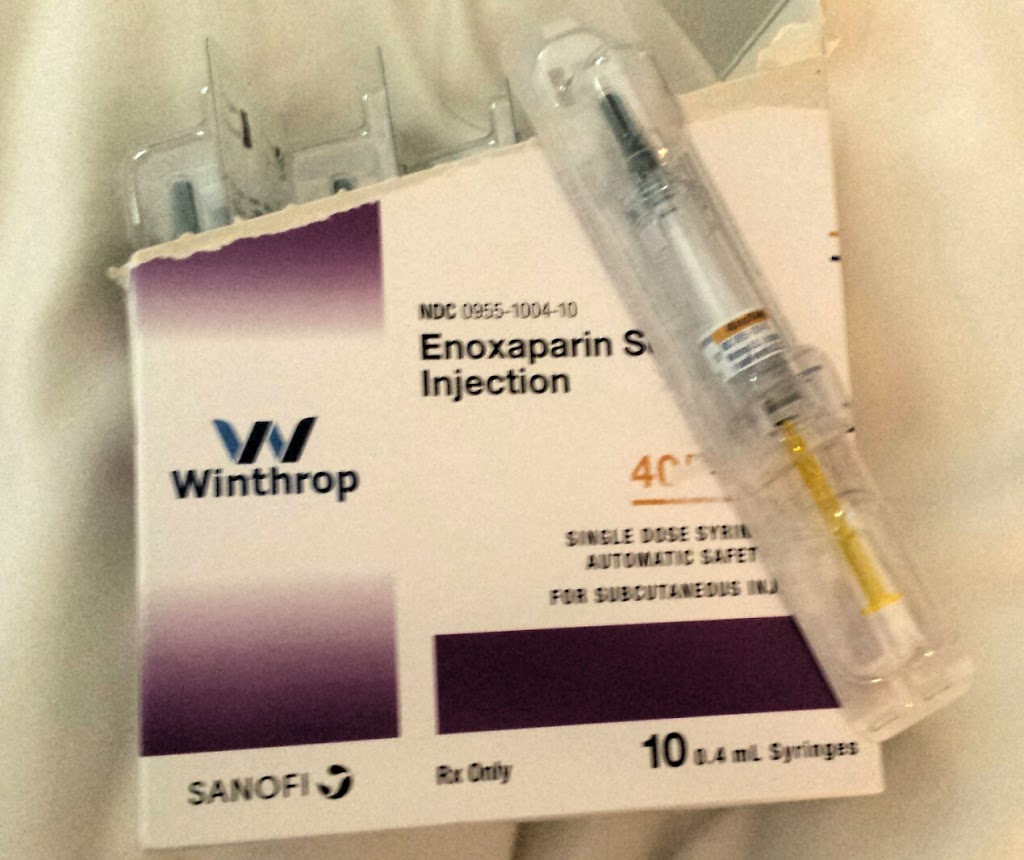

My medical plan is that under certain circumstances, I have to take a blood thinner injection called Lovenox. For example, I flew to Ireland last summer and had to take an injection before each of my six hour flights. No biggie.

About two weeks ago, I had surgery on my ankle. It was a big deal kind of surgery in that I cannot bear any weight on my left leg for 6-8 weeks. That is a blog story to be told all in itself which I will get to soon, I promise.

Because of the non-weight bearing status, I was prescribed Lovenox injections every day for the entire 6-8 week period. My risk of developing a blood clot after surgery was (is) substantial. The injections for me are no big deal. I’m a nurse, I’ve done them before, and it is just a part of the plan for me anytime I need orthopedic surgery.

The day of my surgery was long and tiring. Not to mention stressful. The hospital is two hours away. We had to be there at 6am and I think we got home around 1:30pm. My husband dropped off my prescriptions at the pharmacy. About two hours after I got home, the pharmacy (CVS) called to talk to me about the Lovenox. They wanted to check with me about filling it because the insurance doesn’t cover it and it was going to cost me $550 for a six week supply.

$550.

Let that sink in for a minute.

That can’t be I told them. It must be covered. I have to have this medication. There was nothing they could do I was told.

So I’m still messed up from the general anesthesia and I call my prescription plan, Aetna. I have the Aetna through Medicare Part D. They tell me that the issue isn’t about it being covered. Aetna does cover Lovenox. The problem was that it was a Tier 5 drug AND I was in the donut hole for Medicare.

For those of you who don’t know what that means, the donut hole is the point in your Medicare prescription plan where you have to start paying a much larger portion of your own medications until the total cost of your medications reaches a certain amount. It’s much more complicated than that, but that’s the gist of it. I’m very careful about avoiding the donut hole and this is the first time I’ve gotten there, likely because of a VERY expensive, new eye drop for Sjögren’s that I tried this year. The eye drops were a bust and now it was a bust for my prescription benefits as well.

I told the Aetna representative that this was ridiculous. If I didn’t have this medication, I could die.

I COULD (LIKELY WOULD) DIE.

I asked her if there was anything I could do.

Pay attention here.

This is important.

She said I could have my doctor’s office call Aetna and request a tier exemption. If it was approved, I would be refunded the difference by the pharmacy,

I’ve been a chronically ill patient for quite a few years and I had heard of this. I know that if you need a medication not on the plan’s formulary, your provider can apply for an exemption and get it approved, but I did not know about this tier exemption business. Very good to know.

I got off the phone and called my doctor’s office requesting that my provider call Aetna and request the tier exemption.

Meanwhile, the pharmacist from CVS called me and told me that if the doctor changed the prescription, I could save $200. What?!? This is my second important point in this blog…

Apparently the doctor ordered a 0.6ml syringe but I needed to only give myself 0.4 ml. This means that I would just adjust the syringe before I gave the injection and waste 0.2ml. The pharmacist told me that they medication comes as a 0.4ml syringe and that is why I would save so much money. He told me he had already called my doctor’s office and requested the prescription change and would hopefully have it for me that evening. So my husband and I decided that we would pay the $350 and just pick up the syringes so I could start the medication.

It is SO important to have a relationship with your pharmacist. Mine has known me for years and I truly think he has my best interests at heart. I never would have known about the syringe dosing. It’s obvious from this experience the importance of advocating for yourself in regards to medication prices. Ask your pharmacist if there is an alternative available. In my case here I got the same medication and the same dosage just by somebody paying attention and knowing the medications.

I got my medication. My doctor called Aetna as requested and the tier exemption was approved. I was psyched! I got a letter from Aetna confirming the tier exemption. It didn’t say what the new tier was but I dropped it off at the pharmacy. i called the next day and asked them to run it through for the refund.

It wouldn’t go through.

The pharmacist called Aetna again and he was told that I wouldn’t get a refund because I was still in the donut hole. He then explained to me that right now, it doesn’t matter what the tier or my resulting co-pay is because I am paying the donut hole price for my medication now anyways.

Duh, of course.

Between the lingering effects of the anesthesia and the heavy doses of pain medications, it slipped by me that this was the case: there was no way I could get money back right now. Ten days of going back and forth with Aetna, my pharmacy, and my doctor’s office for nothing. And I only went through all that for the tier exemption because somebody at Aetna told me that was what I needed to do to pay a lot less for the Lovenox.

I did call Aetna and spoke with a supervisor and explained what had happened and that I was upset that while I was recovering from surgery, I had to deal with all this (for ten days and with at least seven phone calls) because their reps are not well informed or knowledgeable about how prescription benefits work. I was told the issue would be addressed. And then, I let it go.

I am going to spend some of my recuperation time this summer comparing Medicare Part D prescription plans so when open enrollment comes in October, I can make a switch if I can find a better plan to suit my needs. In 2017, some of my prescription co-pays have skyrocketed, several of them have a copay price 3x higher than 2016. Maybe this is across the board and I will find there is no better alternative for me, but I have to at least investigate the possibilities.

This whole situation scared me though. I am on disability. I work very sporadically and when I do, it’s not a lot of hours. I am fortunate in that I have a husband who works full-time and makes a good living. I also have a family that I know would never have let me go without this medication. But there was a time that I was single, on disability and not able to work at all. I could not have afforded this medication without help from my family.

So what happens to all the Americans out there who need life saving medications like this and don’t have a husband with a job or a family to go to in crisis? I know people in this situation. And I will tell you, they don’t need that burden on top of already having a severe, chronic illness. Just some food for thought.

I hope this was helpful.

Remember, be informed and ask questions!